![]()

If there’s one constant debate other than which NFL team is the best, it’s which NFL fanbase has the best fans.

It’s become somewhat of a tradition each summer for Dr. Mike Lewis of Emory’s Goizueta School of Business to end this debate on annual terms. This summer is no different.

Lewis’ study to find out the ranking of NFL fanbases measures teams’ brand equity—broadly defined, the level of support each team enjoys in the form of dollars spent, miles traveled, and social media assaulted by its fan base. You can dig into the methodology here, but in basic terms, if a team’s fans spend more money than expected on a team, that team ranks ever higher.

Dr. Mike Lewis –

The basic approach (more details here) is to use data to develop statistical models of fan interest. These models are used to determine which cities fans are more willing to spend or follow their teams after controlling for factors like market size and short-term variations in performance. In past years, two measures of engagement have been featured: Fan Equity and Social Media Equity. Fan Equity focuses on home box office revenues (support via opening the wallet) and Social Media Equity focuses on fan willingness to engage as part of a team’s community (support exhibited by joining social media communities).

This year I have come up with a new method that combines these two measures: Dynamic Fan Equity (DFE). The DFE measure leverages the best features of the two measures. Fan Equity is based on the most important consumer trait – willingness to spend. Social Equity captures fan support that occurs beyond the walls of the stadium and skews towards a younger demographic. The key insight that allows for the two measures to be combined is that there is a significant relationship between the Social Media Equity trend and the Fan Equity measure. Social media performance turns out to be a strong leading indicator for financial performance.

Dynamic Fan Equity is calculated using current fan equity and the trend in fan equity from the team’s social media performance. I will spare the technical details on the blog but I’m happy to go into depth if there is interest. On the data side we are working with 15 years of attendance data and 4 years of social data.

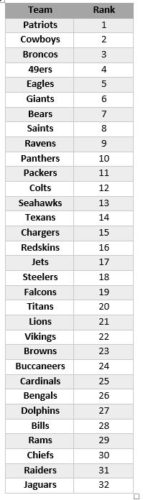

Here is the official 2016 list resulting from Lewis’ findings:

(Click image to enlarge)

The Winners

We have a new number one on the list – the New England Patriots. Followed by the Cowboys, Broncos, 49ers and Eagles. The Patriots victory is driven by fans willingness to pay premium prices, strong attendance and phenomenal social media following. The final competition between the Cowboys and the Patriots was actually determined by the long-term value of the Patriots greater social following. The Patriots have about 2.4 million Twitter followers compared to 1.7 for the Cowboys. Of course this is all relative a team like the Jaguars has just 340 thousand followers.

The Eagles are the big surprise on the list. The Eagles are also a good example of how the analysis works. Most fan rankings are based on subjective judgments and lack controls for short-term winning rates. This latter point is a critical shortcoming. It’s easy to be supportive of a winning team. While Eagles fans might not be happy they are supportive in the face of mediocrity. Last year the Eagles struggled on the field but fans still paid premium prices and filled the stadium. We’ll come back to the Eagles in more detail in a moment.

The Strugglers

At the bottom we have the Bills, Rams, Chiefs, Raiders and Jaguars. This is a similar list to last year. The Jags, for example, only filled 91% of capacity (ranked 27th) despite an average ticket price of just $57. The Chiefs struggle because the fan support doesn’t match the team’s performance. The Chiefs capacity utilization rate ranks 17th in the league despite a winning record and low ticket prices. The Raiders fans again finish low in our rankings. And every year the response is a great deal of anger and often threats.

![]()

Comments are closed.